Stablecoins at $120 Billion Offer Huge Demand for U.S. Treasury Debt: Nic Carter

The U.S. should be courting stablecoin issuers as buyers of sovereign debt, not castigating them, Carter said.

Stablecoin issuers are a major buyer of U.S. government debt and would rank ahead of many American trading partners if treated like a sovereign nation, according to Nic Carter, an analyst and a founding partner at venture capital firm Castle Island Ventures.

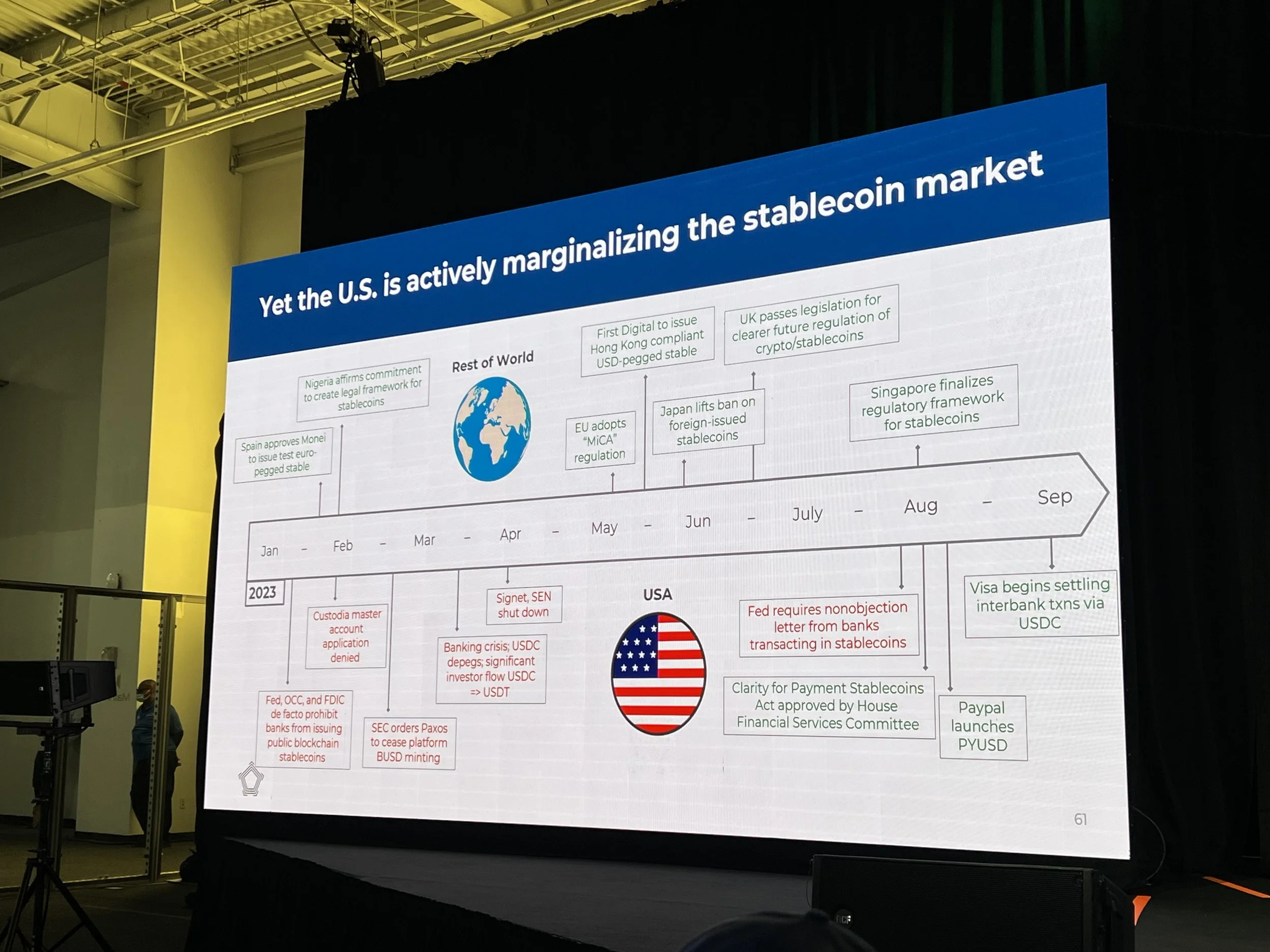

That reality is at odds with how the U.S. regulatory agencies are treating crypto companies, he said.

“Stablecoins are a significant, quickly growing buyer of U.S. Treasuries,” Carter said today at Messari’s Mainnet conference in New York City. “If you count stablecoins as a sovereign nation, they’re actually the sixteenth-largest nation, so to speak, as far as holding U.S. debt is concerned. The stablecoin sector holds around $120 billion of U.S. Treasuries.” That’s more than Saudi Arabia, Germany or Mexico, according to government data.

Earlier this year, crypto Twitter went into a tailspin after Carted posted a warning of an industry crackdown in Washington DC. that he coined in the viral tweet as Operation Choke Point 2.0.

As Washington continues to fight over how to regulate stablecoins, the U.S. is losing onshore stablecoins to friendlier jurisdictions such as Bermuda, Singapore and Hong Kong. “The choice is not stablecoins or no stablecoins. The choice is stablecoins where,” Carter said. “Accountable stablecoins or unaccountable stablecoins.”

A slide from Carter’s address

If the U.S. continues to harass this important sector, they will be issued offshore as dollar stablecoins, yet outside of the control of the government, he said. In August, the Federal Reserve reiterated it doesn’t want banks touching stablecoins, he added.

Rather than harass the industry, the U.S. should realize the buying potential it represents, he said. “The problem is this year we’ve only seen the provocation and marginalization of the stablecoins sector in an extreme way.”

Stablecoin legislation likely won’t pass the Senate, he added. Carter said most of the government’s concerns have been addressed. For example, there were fears of eliminating the centrality of U.S. financial markets, but stablecoins are dollar dominated and major issuers are U.S. based.

Carter concluded his keynote saying Washington has a choice between onshore or offshore stablecoins, not no stablecoins at all. “The market wants dollar stablecoins and we need a new buyer of U.S. debt.”