Karl Jacob Is Using Mortgages to Back a Stablecoin and It’s Not As Terrifying As It Sounds

While bad mortgages were at the heart of the 2008 financial crisis their use to back the stablecoin Bhome is not nearly as alarming as it sounds

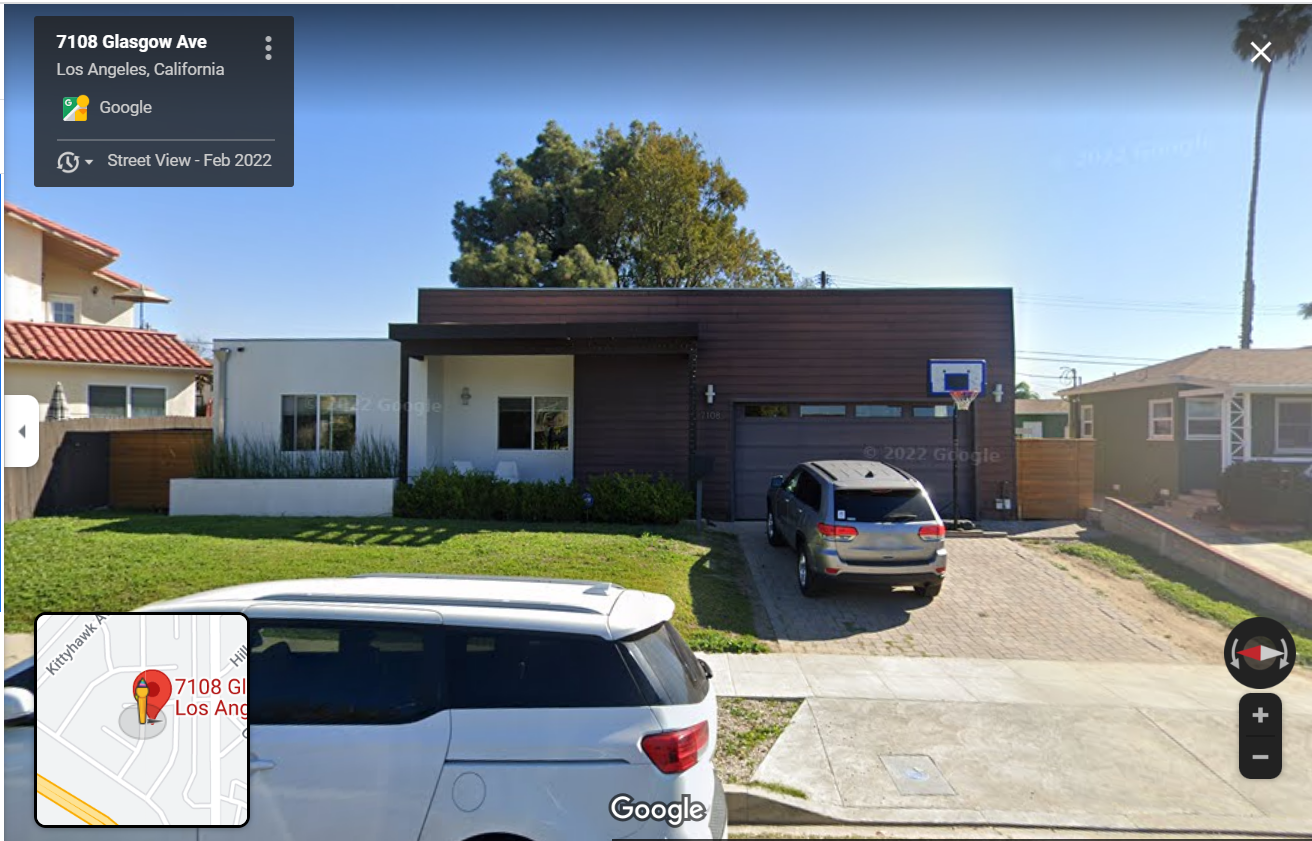

The one-story modernist house at 7108 Glasgow Ave. boasts an exterior of dark hardwood and stucco. The home, on the west side of Los Angeles, is about three miles from the beach. Even closer, the ever busy 405 freeway buzzes nonstop. Oh, and one other thing: the $250,000 mortgage used to buy the dwelling is among a pool of loans backing a new stablecoin called Bhome.

This is 2022, and many crypto enthusiasts love to tell newcomers that “it’s still early.” That may be true, but the house on Glasgow tells a slightly different story. Hard-money assets such as mortgages are now being used to ensure stablecoins don’t wildly fluctuate in price.

But wait, you’re saying, haven’t I seen this movie? Pooled mortgages, financial engineering, a global recession in 2008 that rivaled the Great Depression?

Yes and no.

The 2008 financial crisis left many scars on the global economy and soured taxpayers around the world on Wall Street’s use of derivatives and other complicated products. Mortgages were granted to borrowers who banks knew couldn’t repay their loans, becoming a chief culprit in the crisis. So nearly fifteen years later the idea of using home loans to back a stablecoin may strike many as incredibly risky and ignorant of recent history.

Karl Jacob is here to convince you otherwise.

The chief executive officer and co-founder of lender LoanSnap has been in the mortgage business for about eight years. He didn’t go through the credit crisis as a home lender, which he said is a good thing, because LoanSnap aims to reinvent how borrowers get a mortgage from top to bottom. The stablecoin Bhome is one component of that plan along with modernizing and streamlining the laborious mortgage application process. Bhome derives its value, and stability, by being backed by group of pooled home loans it uses as collateral.

The mortgage on this home is Los Angeles is used to back the stablecoin Bhome

Ok, wait again, this sounds a bit like collateralized debt obligations, or CDOs, of credit crisis fame, doesn’t it? I thought the same thing, but after speaking to Jacob about the details of Bhome, which is powered by the Bacon Protocol, I came away much less worried. And in the wake of the Terra stablecoin meltdown where $40 billion was lost due to its overly-complicated design, it’s reassuring to have actual collateral such as houses and mortgage payments backing a stablecoin.

Here's how it works. Through LoanSnap, Jacob is underwriting loans to wanna-be homebuyers, using standards acceptable to U.S. government mortgage backers Fannie Mae and Freddie Mac. Once the mortgage is granted, LoanSnap keeps it on their books rather than sell it as most mortgage companies do. That incentivizes them to write good loans to people who can repay them, keeps their customer relationships, and brings in revenue for up to thirty years from loan repayments. If a borrower defaults the firm can sell the house that backs the loan.

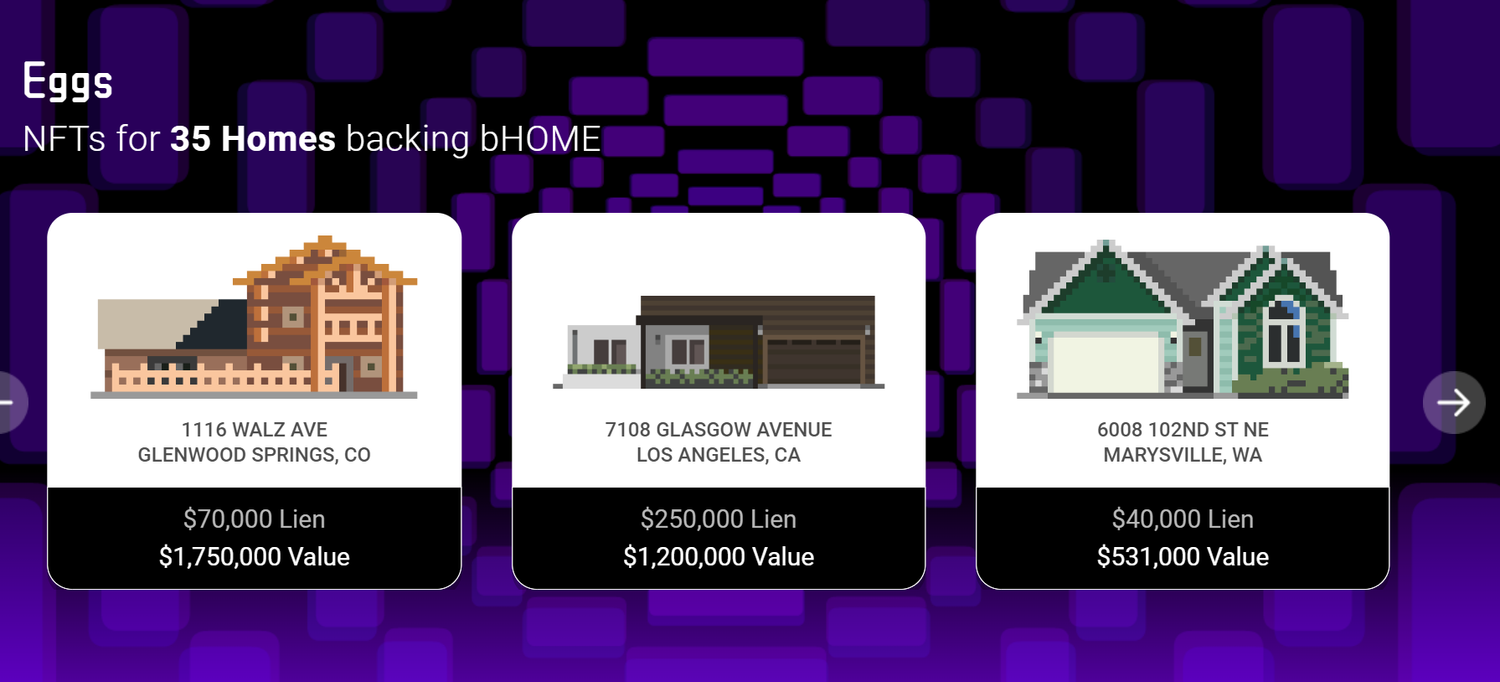

From the Bacon Protocol web site

If you know your way around the 2008 disaster, you’ll see that no giant pools of varying-quality mortgages are being created, sliced, and sold to investors around the world. No derivatives like credit default swaps are being used. The LoanSnap debts are publicly posted on the Ethereum blockchain using a non-fungible token so Bhome users can see the source – and verify the loan at the local county recorder’s office – that created their coins.

One Bhome is created to match each dollar in the value of a loan LoanSnap issues. Holders receive a return based on the mortgage payments that get passed through from the collateral pool. Right now, it’s paying about 3.5 percent, according to the Bacon Protocol web site. Check with your local bank to compare the rates you get on your savings account (or don’t, if you don’t want to be depressed.)

The whole thing seems, at least, like a pure mortgage play with none of the bells and whistles that almost crashed the global economy. Of course, a bad downturn in the broad housing market is a risk to LoanSnap and Bhome, in the same way that rising mortgage rates will increase the payments to Bhome holders.

Above: Frank Chaparro of The Block, like me, was initially skeptical of using mortgages to back a stablecoin but has come around to the idea since posting this tweet

The emergence of decentralized finance protocols a few years ago showed Jacob and others at LoanSnap that the possibility to do mortgages differently now existed.

“Seeing lending protocols like Aave and Compound definitely piqued our interest,” Jacob recently told me. “That’s the other part of this, seeing the liquidity -- or dollars -- out there that could be invested in something we felt was a better stablecoin seemed like an opportunity.”

LoanSnap is also working to streamline the cumbersome process of getting a mortgage, which typically involves mountains of paperwork and weeks or months of time to complete. Using artificial intelligence and consumer data that’s pulled with customer consent to fill out paperwork, Jacob said LoanSnap has closed a mortgage in 24 hours. In a nutshell that’s the promise of web3, where radical gains in efficiency are married to an all-inclusive system that allows people to participate in areas of finance and culture that were previously closed to them.

“We built a system with the idea of having a distributed balance sheet” that allows “anyone around the world to participate in the mortgage market without owning a house or without buying bonds and a whole bunch of these high-end financial instruments that are both expensive and complicated,” Jacob said.

“How do we take this amazing product that’s really the purview of governments and banks and rich people and bring it to everyone?” he said.

Bhome is also hoping to set a new standard for stablecoins that are transparent and decentralized. “The stablecoins that people used, no one would tell you what’s backing those stablecoins,” Jacob said. Tether, the most-used stablecoin, is a prime example of this lack of transparency, though it has begun releasing more information on what it holds to back its coins. The collateral backing Bhome can be seen by anyone as it’s on the Ethereum blockchain.

“The tools to audit us are public,” he said. “Leveraging the tools that [traditional finance] uses in order to stabilize their portfolio-slash-balance sheets is something you can apply to the average consumer. The idea that you can be in Germany, where for a while there was negative interest rates, and you can buy Bhome and get a 3 percent return backed by U.S. mortgages just blows my mind and gets people really excited.”