Crypto for Good: The Giving Block Is Helping Hurricane Victims as it Transforms Fundraising

The crypto charitable fund is set to raise $200 million this year and is working with 20 nonprofits to help Hurricane Helene victims so far

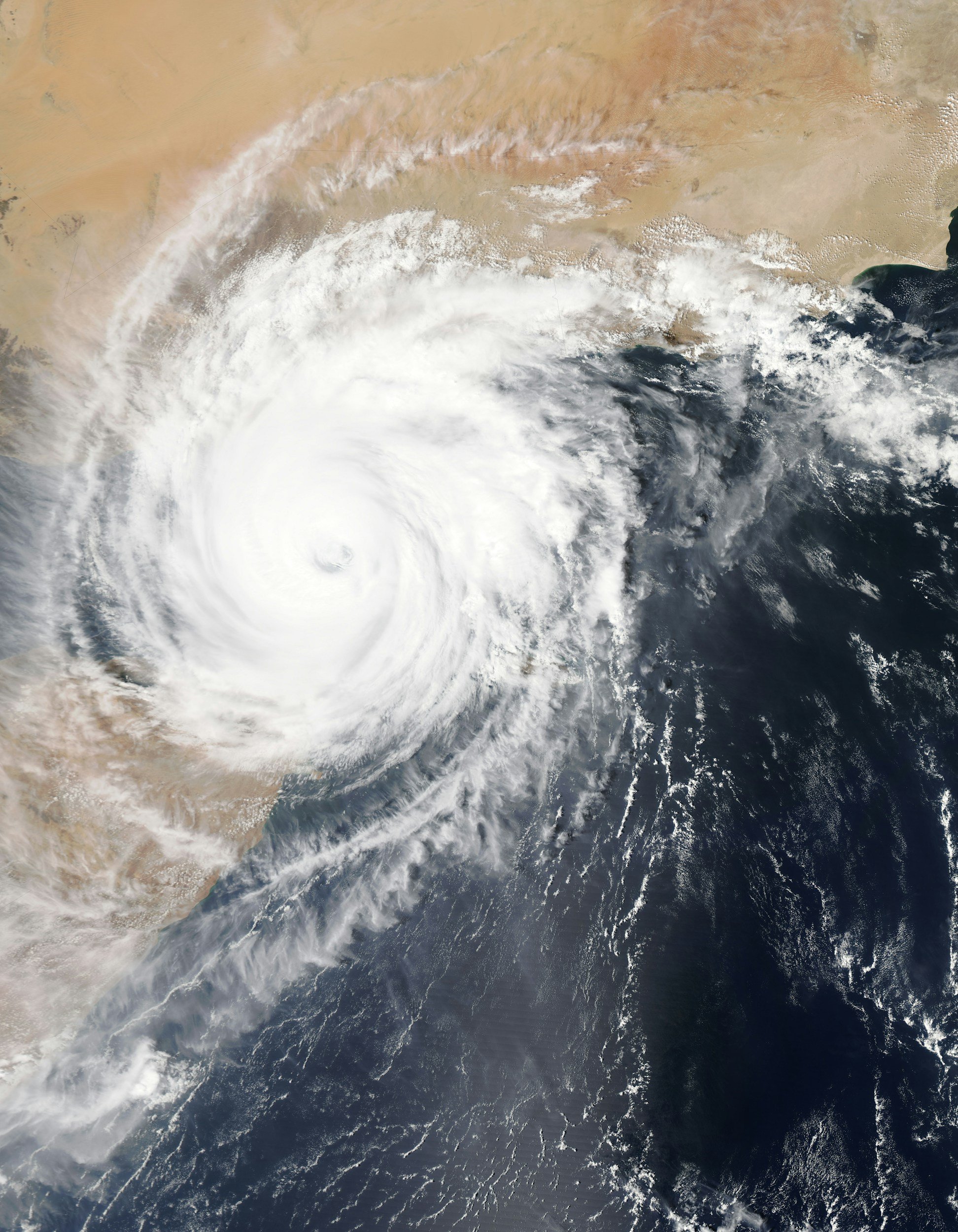

Hurricane Helene has been compared to the North Carolina historic flood of 1916, when back-to-back hurricanes dropped more than two feet of rain on the region. Helene decimated an area that wasn’t built to withstand hurricanes because they didn’t happen so far inland. Two weeks later, Hurricane Milton tore across Florida, further devastating the region.

Even with the scale of destruction, the news cycle moves on, especially just a month out from the November election. The Giving Block, a crypto fundraising company, exists to combat this – initiating crypto-driven rapid response efforts to communities in crisis zones.

The crypto fundraiser is on target to raise $200 million in digital-asset donations for nonprofit organizations worldwide this year – its best donation period on record. More broadly, crypto charitable giving is expected to grow to $10 billion in the next decade.

Pat Duffy, co-founder of The Giving Block, said that while current donation levels are great, the total could be much larger given the tax treatment afforded to donating Bitcoin, Ether or other digital assets.

“So many crypto users have no idea how powerful the tax incentives are to give this way,” Duffy said in a recent interview. “Despite the fact that they're already so generous, there would be millions more people considering this form of generosity if they knew how easy and tax efficient it is.”

Why? “There’s a reason people choose to give crypto versus cash. It’s because you don’t pay capital gains tax on the crypto you give,” he said.

Listen: DeCent People Podcast With Ben Simon of FreeWill’s Crypto for Charity

Duffy came from the nonprofit world, where accepting crypto was nearly impossible. It was a long and convoluted process that required a wallet, an exchange account, a two-month waiting period in a highly volatile market, updating the gift acceptance policy for the charity and dealing with tax documentation.

To counteract those headaches, Duffy and co-founder Alex Wilson built a solution for nonprofits to automatically accept and sell crypto, and move it to a bank account to put to use immediately, while remaining tax compliant.

In other words, making charities crypto-ready in a crisis.

“It can be a real mess to give crypto directly to a charity that isn’t properly equipped for it,” Duffy said. He cited Vitalik’s $1 billion donation to India during Covid that shrank to around $50 million.

The fundraiser has identified 20 nonprofits that are in the Hurricane Helene fund and focuses on giving aid to local, national and international organizations that are helping rebuild after disasters. The goal is to raise $1 million to help rebuild after Helene and Milton. Jared Isaacman, CEO of the Giving Block’s parent company, Shift4, donated $500,000, with a one-to-one match on all donations. Duffy expects the remaining funds will be raised within the next week.

Duffy referred to crypto as a “future proof donor base” that will help charities ride out the great wealth transfer. In the seven years The Giving Block has been operational, crypto donors tend to give generously, he said.

According to Fidelity Charitable data, one in three cryptocurrency investors has donated crypto assets to charity. Not only are they more charitable, but they’re more valuable donors. Duffy said crypto donors trend younger, even though they’re less likely to have built wealth or have reached the same earning ranges.

Image courtesy of Southern Paws Inc.

Standard credit card donations can cost charities upwards of 10 percent in processing fees, which is dramatically cheaper with crypto. Although Duffy admitted crypto fundraising isn’t always easy to navigate with the market volatility and charities being burned, such as with the collapse of FTX, he said it’s an efficient giving method.

“The more exciting thing is the average donation size,” he said. “The average online gift through credit cards is $100 to $200 for a charity. The average crypto gift ranges from $5,000 to $15,000 on an annual basis. It's 30 to 80 times larger than the average gift size from donors who are, on average, 20 to 30 years younger.”