Central Bank Digital Currencies Have Potential Uses Amid Some Uncertainty, Australian Government Says in Report

Legal and regulatory issues remain to be solved yet a CBDC could improve some payment systems

A central bank digital currency has the potential to improve some types of payment systems while still facing many legal and regulatory issues, a report from the the Reserve Bank of Australia (RBA) and the Digital Finance Cooperative Research Centre (DFCRC) said.

Sixteen firms ranging from large financial institutions like major banks and credit card issuers to SME fintechs participated in a four-month pilot program to investigate uses for an Australian CBDC, or eAUD, ranging from cross-border payments, business-to-business transactions and even household use cases.

Read more: Australian Government Throws Its Digital Hat in the Ring With eAUD Pilot Program

The report concluded that a “CBDC has the potential to support increased efficiency and resilience in some areas of the payments system” yet also acknowledged that “a range of legal, regulatory, technical and operational issues associated with CBDC” need further research.

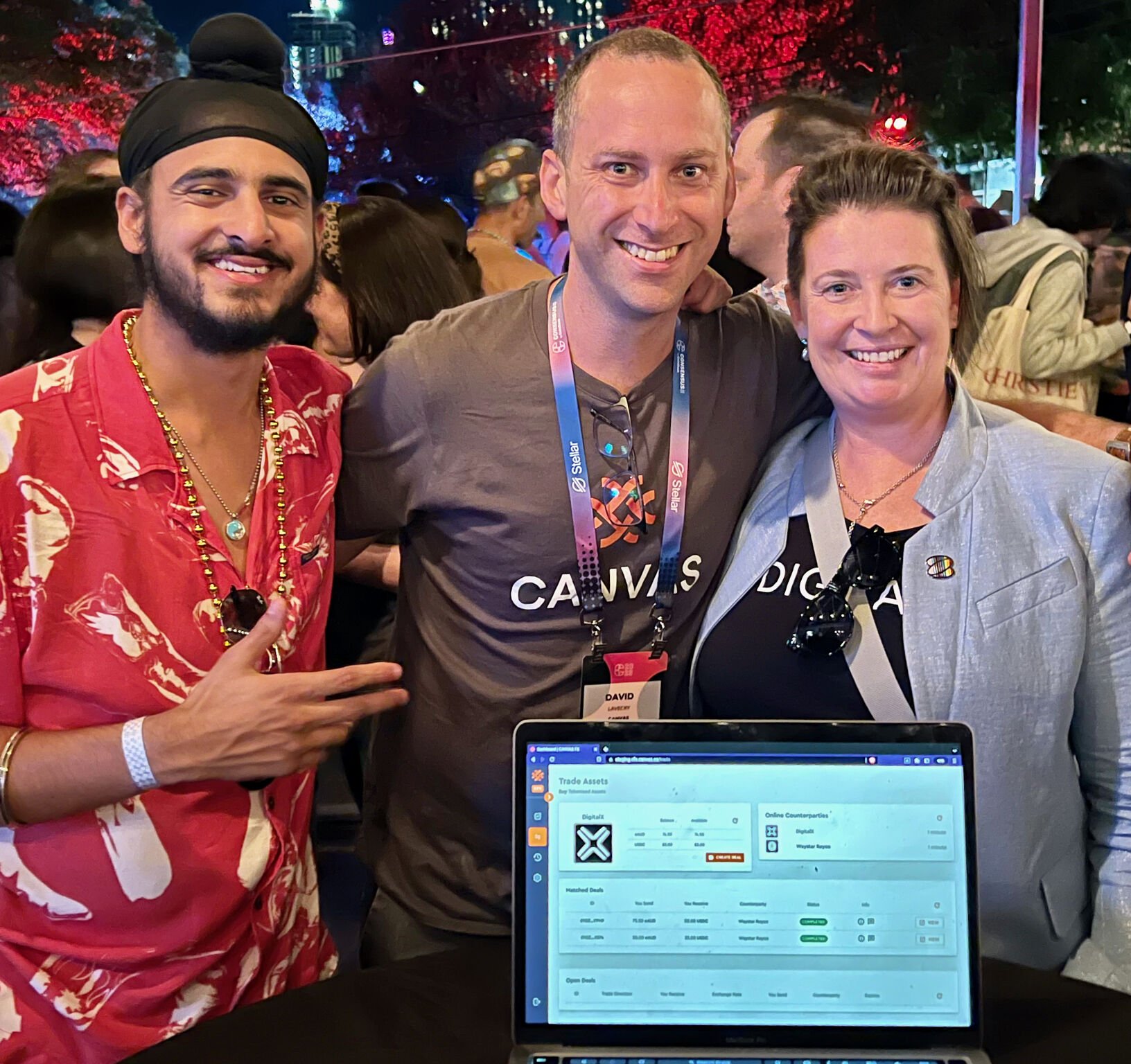

During the pilot, CANVAS, a fintech firm, conducted Australia’s first ever foreign exchange transaction using CBDCs (eAUD to USDC). CANVAS Chief Executive Officer David Lavecky said at the time, “Our use case demonstrates the benefits of using CBDCs in tokenized FX transactions and how our privacy focused Layer 2 blockchain provides improvements over traditional markets by eliminating market inefficiencies, errors, and settlement risks.”

The CANVAS platform completed Australia’s first event FX transaction using CBDCs. It was successfully completed between ASX listed DigitalX (ASX:DCC), and Fund Manager TAF Capital, to trade eAUD to USDC stable coin on 17th May.

“The key findings from the project will help to shape the next phase of the RBA’s research program into the future of money in Australia,” Brad Jones, Assistant Governor (Financial System) at the Reserve Bank of Australia (RBA) said in a statement. “Alongside our ongoing work on cross-border payments, this will include deepening our understanding of the role that tokenized asset markets and programmable payments could have in the Australian economy.”

While the overall industry response to the report has been favorable, it is clear that the pilot program has raised a raft of questions and concerns for the Australian government around regulation and legislation, something that may take months or years to work through. An Australian CBDC may not in fact be as close to realization as many in the blockchain space would like.

A move to transition the Australian Stock Exchange to a system using blockchain to settle transactions faced years of delays before being abandoned in November.

Steve Vallas, Managing Director at Blockchain APAC noted in his most recent post on Linkedin that “Australia is lagging in the conversation around stablecoins” and that the “Singaporean approach will shape the region.” Vallas was referring to the Monetary Authority of Singapore’s Regulatory Framework in regards to single currency stablecoins.

Released earlier this month, the framework is the result of an industry consultation process that commenced in 2019. MAS has confirmed that it will regulate stablecoins “pegged to the Singapore dollar or Group of 10 (G10) currencies that are issued in Singapore.” The G10 currencies are the Australian dollar, British pound, Canadian dollar, euro, Japanese yen, New Zealand dollar, Norwegian krone, Swedish krona, Swiss franc and the U.S. dollar.

“Other types of stablecoins will not be prohibited from being issued, used or circulated within Singapore,” the report said. “Such stablecoins, including SCS issued outside of Singapore or pegged to other currencies or assets, will continue to be subject to the existing DPT regulatory regime. MAS will continue to monitor developments in the stablecoin landscape, with a view to bringing other types of tokens into the SCS framework.”